How it works

Help build smart money habits early with Kit's nifty features for parents, carers, and your little grownups.

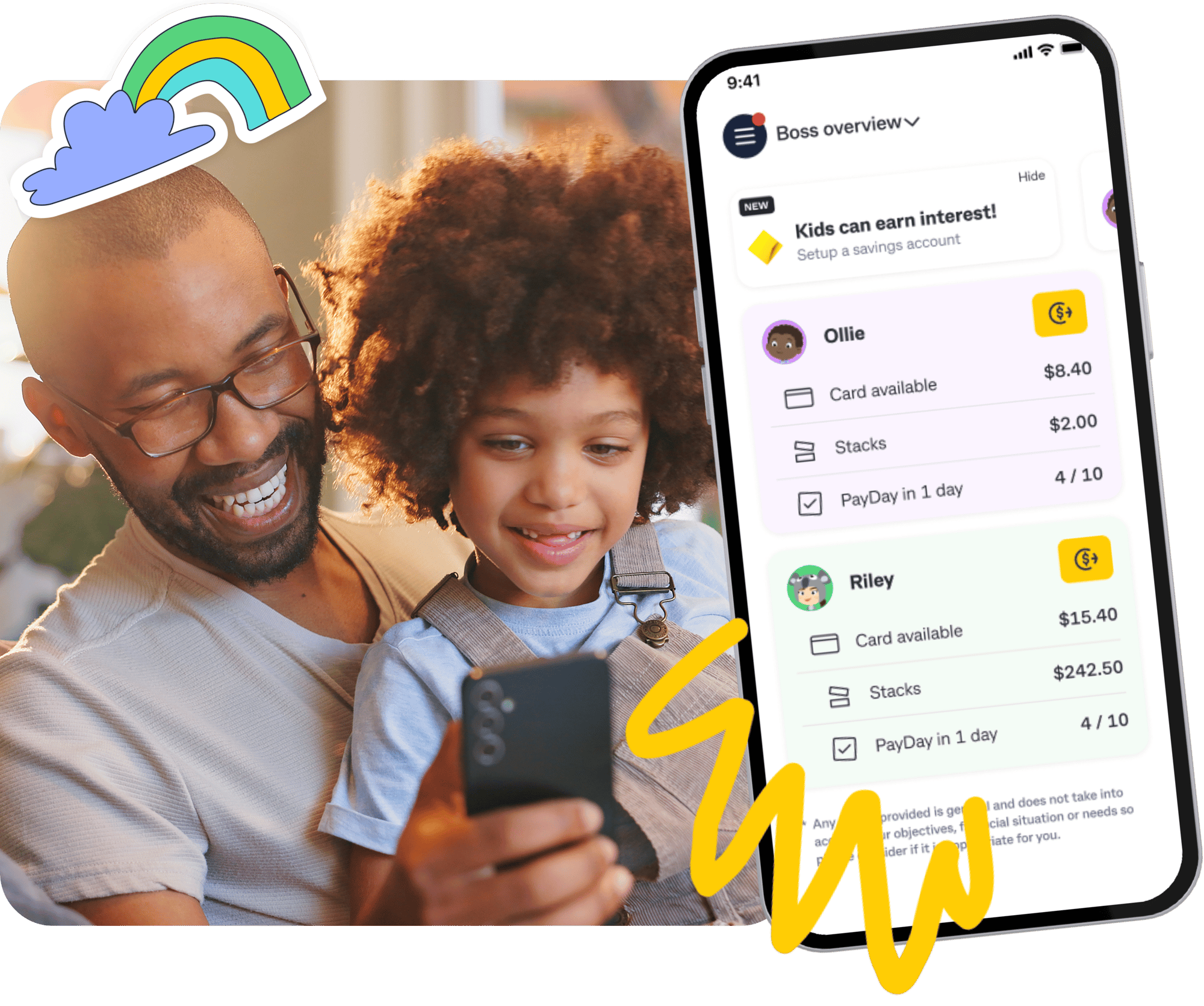

Get peace of mind with parental controls

Take control with Boss Mode - customise parental settings for each child.

- Real-time money transfers to your kid with PayTo, ensuring they have access to funds when they need it.

- Monitor spending, set limits, and block specific merchants to guide your child's financial journey.

- Real-time notifications of your kid's spending.

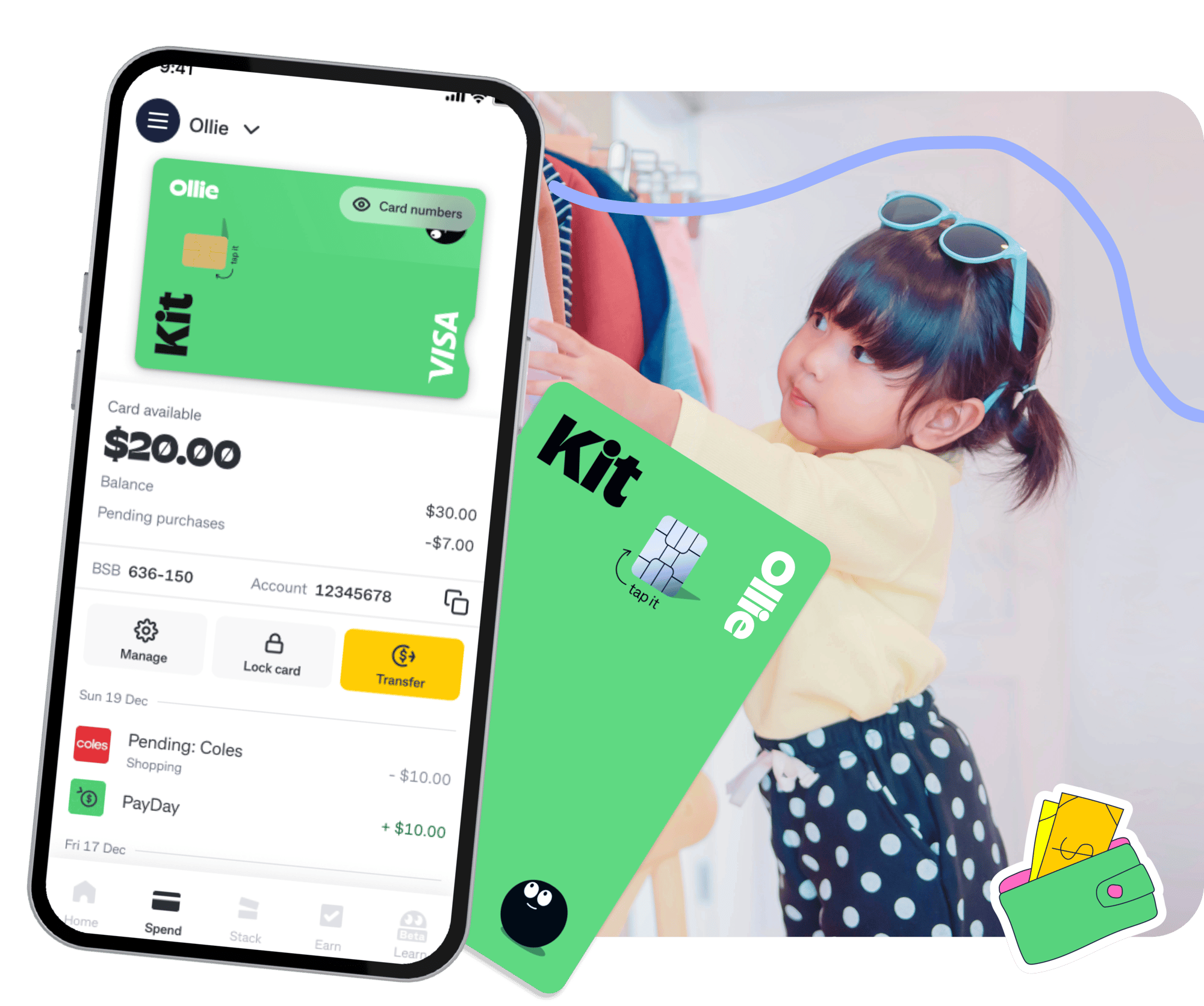

Help teach kids to spend mindfully

Empower kids to manage money with Kit’s prepaid card - available physically and digitally in-app.

- Let them choose a personalised card in one of six colours and set up their Kit card with Apple Pay or Google Pay™ across multiple devices.

- View a detailed transaction history.

- Withdraw money from ATMs or tap to spend in store.

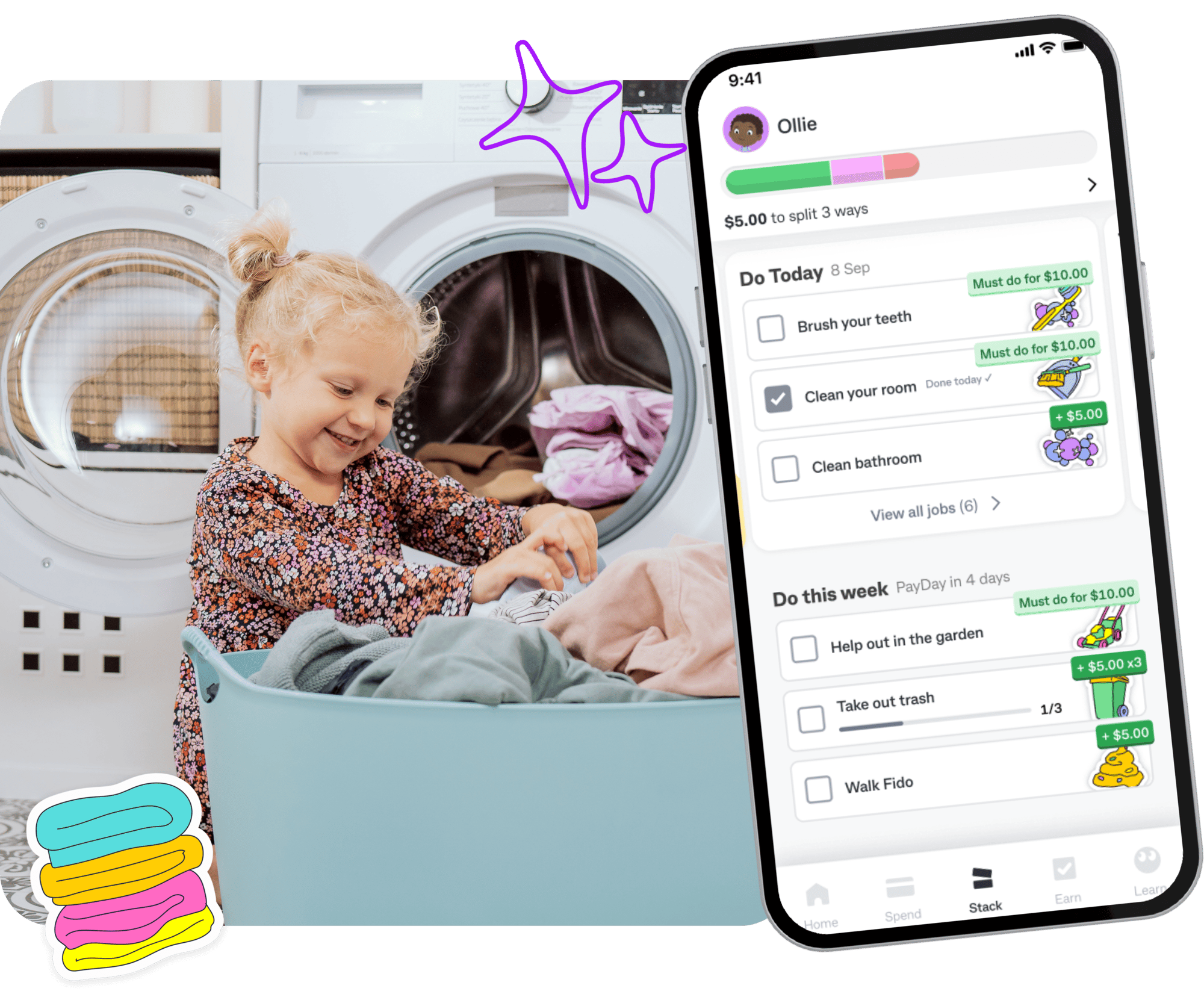

Set up pocket money and chores with ease

- Customise pocket money with regular, one-off, or no jobs at all.

- Assign a day, track, and manage ‘Jobs’ for your child easily.

- Automate PayDay with or without parental approval.

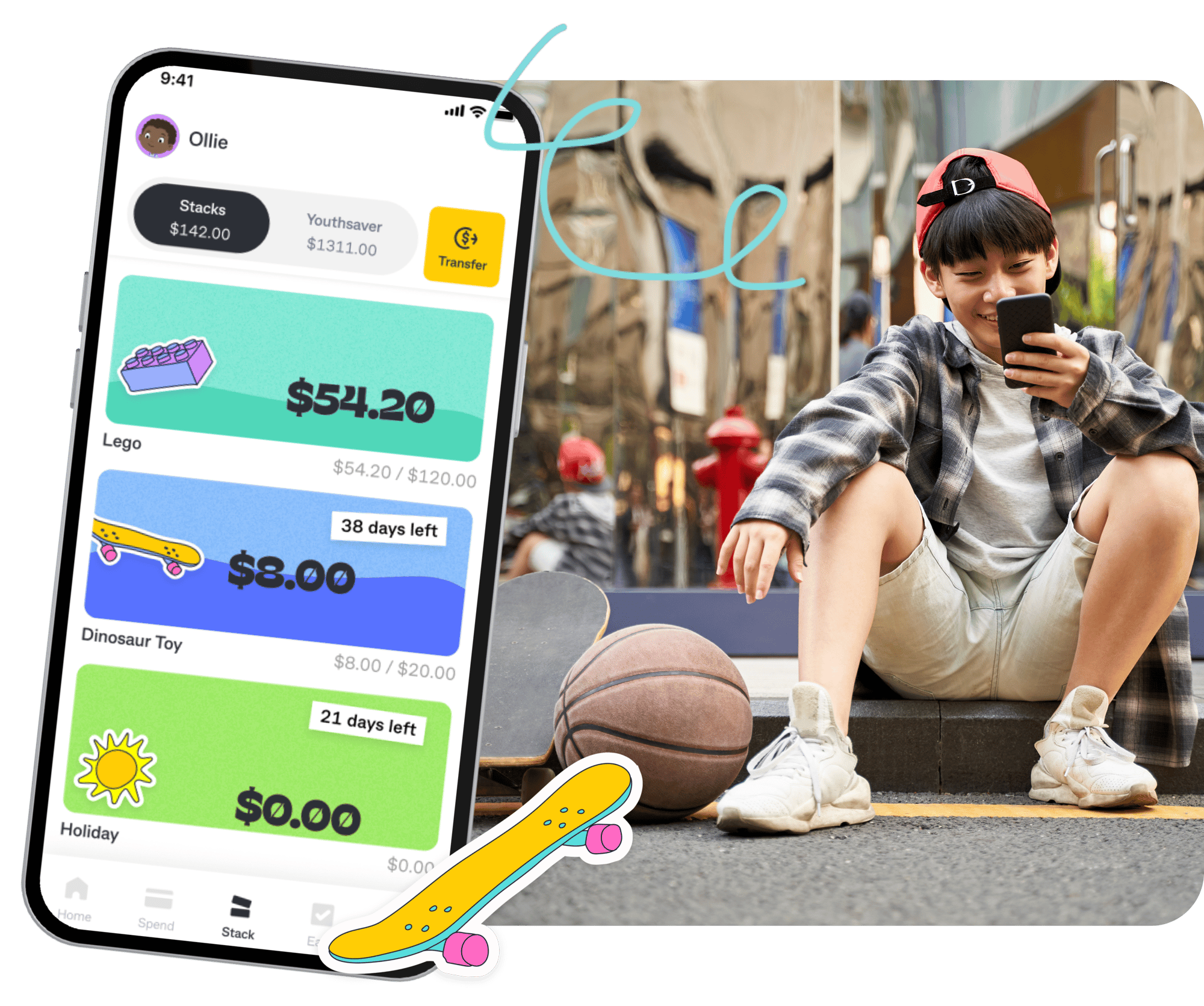

Motivate kids to reach their savings goals

Encourage goal setting with Kit’s interactive savings goals feature, ‘Stacks’.

- Create savings stacks and watch them fill up with a rising water level when money is added to the account.

- Get reminders about upcoming goal due dates.

- Your kids can customise their ‘Stacks’ with their favourite colours and stickers and give their goal a name.

In-app learning nudging real-world behaviour

Send your kid on engaging in-app games and quizzes, 'Money Quests', with their smart money sidekick, Kit, in our gamified learning.

- Quests take place in the Moneyverse and include mini games, rewards and nudges, making learning fun and engaging.

- Test their money savvy skills with fortnightly quizzes available in-app.

Now they can earn interest on their pocket money

With Youthsaver, your kids could start earning interest on savings in their Youthsaver account.**

Link a Youthsaver account to Kit and your kids can:

- Keep track of their Youthsaver savings within Kit.

- Make transfers from Kit to their Youthsaver account.

Let kids express themselves in the Moneyverse

Our avatar creator lets your kid choose their own look in Kit's 'Money Quests'.

- Unlock 70+ items for their avatar – because in the Moneyverse, creativity is limitless!

- Redeem more items with Kit's in-game currency, 'Winkits'. The more your kid learns, the more they earn.