Now they can earn interest on their pocket money.**

Why link a Youthsaver account to Kit

Once a Youthsaver is linked, your kids can:

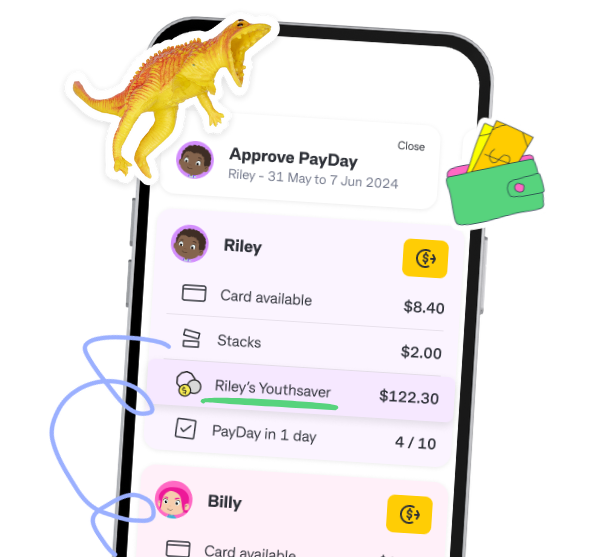

✔️ Keep track of their savings within Kit

✔️ Make transfers from Kit to their Youthsaver account

Earn bonus interest with a Youthsaver account (eligibility criteria applies)

Whether they’re saving for new headphones, a new top from their favourite shop or something BIG, they can now link CommBank’s Youthsaver to Kit so that they can keep track of their savings!

Frequently asked questions

A Youthsaver account is an interest-earning savings account for under 18s offered by the Commonwealth Bank. It has no monthly account fees, and your child can earn bonus interest by growing their savings balance each calendar month (excluding interest and transactions initiated by the Bank).

For more information and current interest rates offered, visit the CommBank website.

Understanding the concept of interest is a key part of kids’ financial capability. By linking a Youthsaver account with Kit, kids can learn about interest from within the Kit app.

When you link a Youthsaver account, kids can unlock additional functionality in the Kit app:

- View their Youthsaver balance and transaction history.

- With your permission, transfer savings into the Youthsaver account to earn interest, including automatically saving part of their PayDay into the account.

- See the interest earned on the account.

Note that kids are unable to transfer money out of Youthsaver back into Kit from within the Kit app.

Why is my previously linked Youthsaver account no longer be visible in the Kit app.

To link an account, the Boss must be an authorised operator of a Youthsaver account and have the CommBank and Kit apps on the same device.

You can link one or more Youthsaver accounts to your child’s profile.

When you link a new or existing Youthsaver with Kit, you agree to CommBank sharing these details with Kit:

- BSB and account number

- Name

- Balance

- Transaction history.

This is so your kids can see the Youthsaver in Kit with it’s up to date balance and history, and transfer directly to it with your permission as the Boss.

The data share will last for 12 months or until you choose to stop sharing. Kit does not store this information at any point. Your permission allows Kit to ask CommBank for it, but it is not held with Kit.