How it works

Help build smart money habits early with Kit's nifty features for parents, carers, and your little grownups.

.png)

Get peace of mind with parental controls

In Boss Mode, you can customise parental controls for each kid.

- Real-time money transfers to your kid with PayTo.

- Set and manage spend controls and merchant blocks.

- Real-time notifications of your kid's spending.

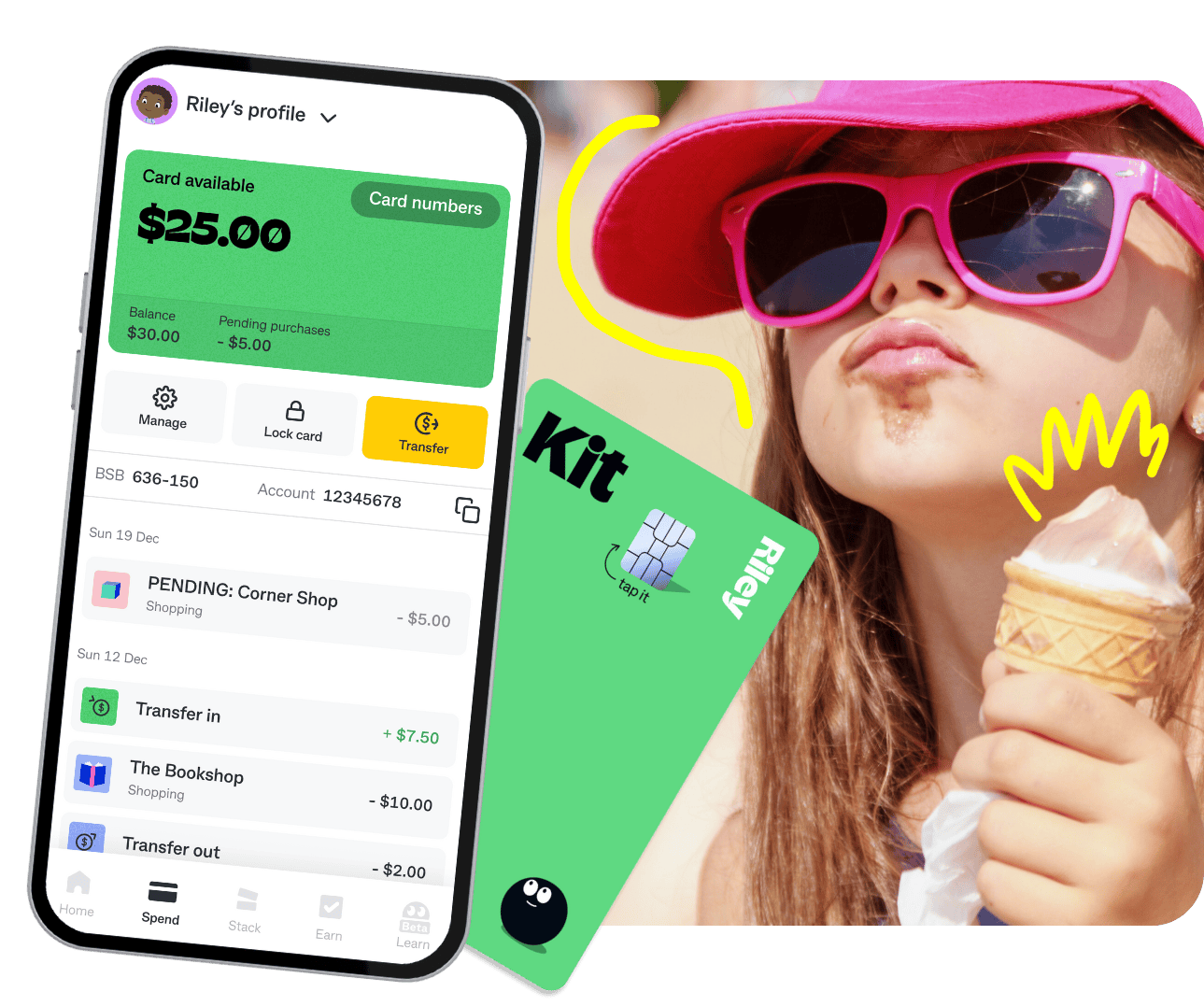

Help teach your kids to spend mindfully

Spend it with a prepaid physical and digital card available in-app.

- Let them choose a personalised card in one of four colours and set up their Kit card with Apple Pay or Google Pay™ across multiple devices.

- View a detailed transaction history.

- Withdraw money from ATMs or tap to spend in store.

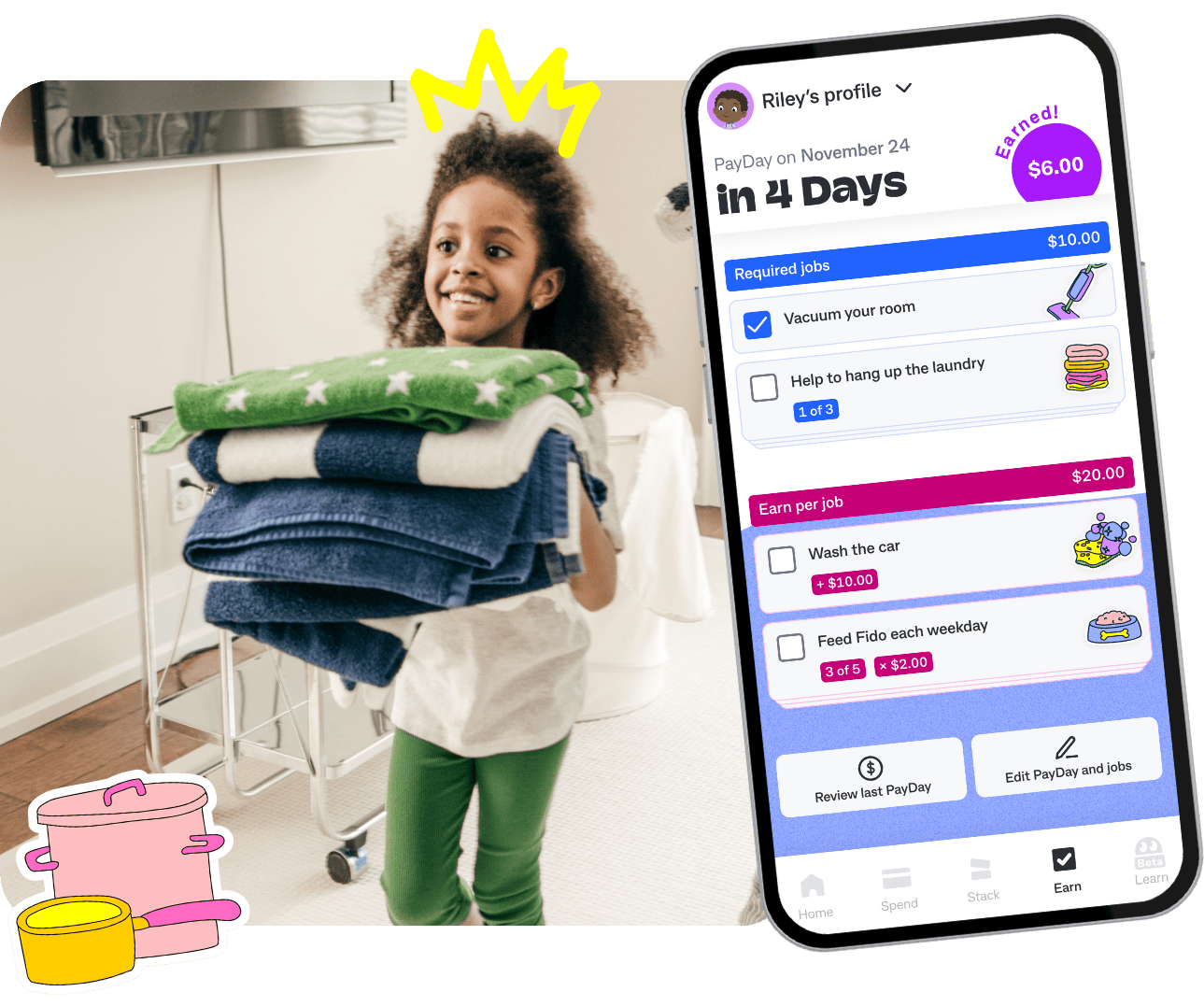

Easily set up pocket money and jobs

Set up PayDay so your kid can earn pocket money for jobs they complete.

- Customise pocket money with regular, one-off, or no jobs at all.

- Track and manage their completion of jobs.

- Automate PayDay with or without parental approval.

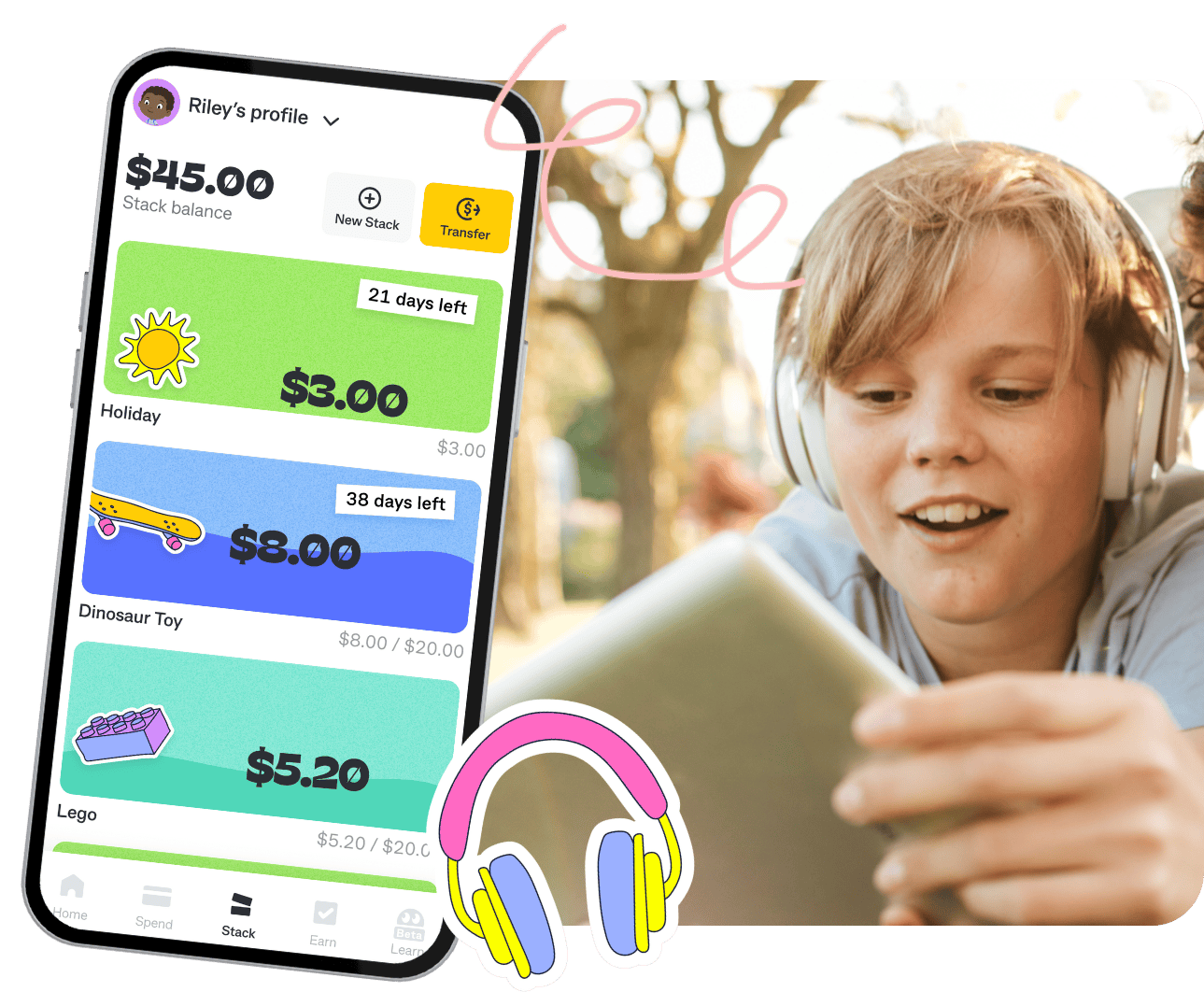

Help motivate your kids to achieve their savings goals

Stack it by creating savings stacks that encourage your kid meet their money goals.

- Create savings stacks and watch them fill up with a rising water level when money is added to the account.

- Get reminders about upcoming goal due dates.

- Your kids can customise their stacks with their favourite colours and stickers and give their goal a name.

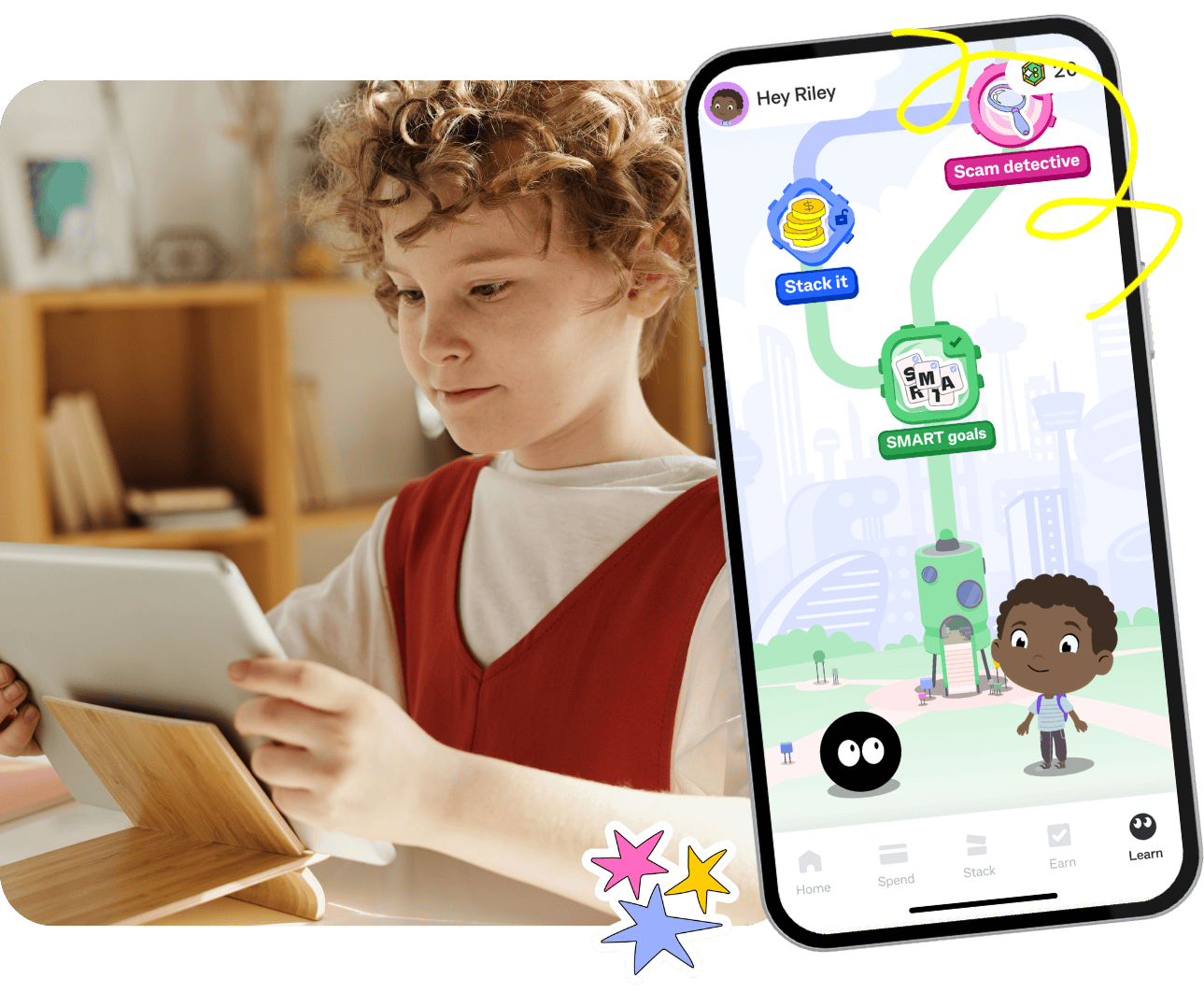

In-app learning nudging real-world behaviour

Send your kid on Money Quests with their smart money sidekick Kit in our gamified learning.

- Quests take place in the Moneyverse and include mini games, rewards and nudges.

- Test their money savvy skills with fortnightly quizzes available in-app.

Now they can earn interest on their pocket money.**

With Youthsaver, your kids could start earning interest on savings in their Youthsaver account.

Link a Youthsaver account to Kit and your kids can:

- Keep track of their Youthsaver savings within Kit.

- Make transfers from Kit to their Youthsaver account.

Let your kids express themselves

Our avatar creator lets your kid choose their own look in Kit's Money Quests.

- Unlock 70+ items for their avatar - because in the Moneyverse, creativity is limitless!

- Redeem more items with Winkits. The more your kid learns, the more they earn.